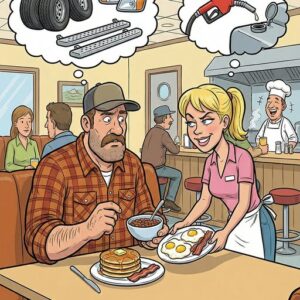

Introduced by Senator Ted Cruz of Texas and co-sponsored by Senator Jacky Rosen of Nevada, the legislation is designed to support workers in sectors like hospitality, food service, and delivery—jobs where tipping often makes up the majority of income.

“This is about fairness,” Senator Cruz said. “These workers are putting in long hours and living paycheck to paycheck. They deserve to keep more of what they earn.”

Senator Rosen added that in states with tourism-heavy economies, such as Nevada, service workers are the “backbone of the economy,” and this bill gives them “the respect and support they deserve.”

What the Bill Does

The No Tax on Tips Act proposes amending the federal tax code to make tip income exempt from federal income taxes. Under current law, tipped workers must report their tips as income, and employers are required to withhold taxes. If the bill becomes law:

- Tips from customers would still need to be reported.

- They would no longer be taxed at the federal level.

- The change applies to tips only—not wages or employer-paid bonuses.

Supporters say this change simplifies reporting, eases burdens on small businesses, and increases take-home pay for workers.

Reaction and Outlook

The bill has been met with strong approval from worker advocacy groups and service employees, who say it could lead to hundreds or even thousands of dollars in annual savings.

While some tax experts have raised concerns about enforcement and impacts on Social Security contributions, lawmakers say these are manageable issues.

The bill now moves to the House of Representatives, where it is expected to be debated in the coming weeks.